www.dataroom-rating.org/the-importance-of-online-ma-transaction-management-for-business-success

M&A deals require a lot of paperwork. By digitizing documents, vdr is able to reduce costs. It allows parties to access the data at their own time to reduce scheduling conflicts and delays. The security features that are built into VDRs VDR will also help ensure that the information is private throughout the transaction.

When choosing the best VDR for M&A It is essential to think about the volume of documents, number of users and the desired security features. You’ll need to decide on the method of payment for the service. A majority of providers charge a monthly fee, and charge additional fees dependent on the storage capacity and features. Finally, it’s critical to establish clear ownership and responsibilities for the VDR content, such as internal M&A teams or external advisors that are responsible for certain aspects of the deal. This will ensure that only authorized users have access to access data, preventing accidental or intentional disclosures.

Using the VDR for M&A can also be an efficient way to share sensitive information with potential buyers, eliminating the need for physical meetings or email. Apart from providing an centralized platform for due diligence and due diligence, a VDR for M&A also comes with documents that expire and deactivate that limit access to data to a predetermined time. VDRs also provide real-time auditing and reporting functionality to monitor user activity. This helps administrators identify and address issues promptly and avoid any misinterpretations or confusion of the information. This is especially important when dealing with international buyers who have different cultures of work.

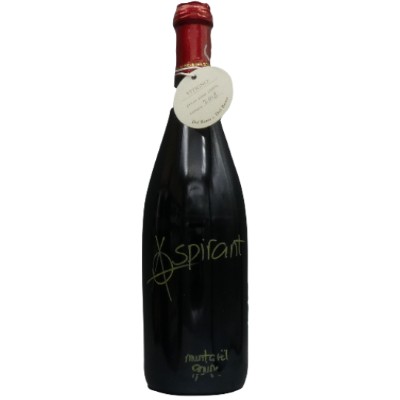

Vini Rossi

Vini Rossi

Vini Bianchi

Vini Bianchi

Spumanti

Spumanti

Champagne

Champagne

Vini Dolci

Vini Dolci

Vini Rosati

Vini Rosati

Vini Liquorosi

Vini Liquorosi Vini Aromatizzati

Vini Aromatizzati