Data rooms can be used for a variety of reasons such as M&A, investment management, strategic reviews, and tenders. The secured, controlled environment they provide is crucial in achieving the results you want. With a simple user interface and a flexible solution designed to fit your workflows, Firmex makes it easy for companies to adopt and modify their VDR to meet their requirements even for complex projects.

A virtual data room is an online repository where you can securely communicate confidential documents that are not within your firewall. This information can include legal agreements, contracts and other sensitive documents that your business or company created. When sharing these documents it is crucial that the process of sharing documents be simple and quick for everyone virtual data rooms for transactions and deals involved. This means that the structure of the document is well-organized and numbered, the search function works effectively and all documentation can be easily retrieved.

Additionally, the capability to delete sensitive information in bulk helps ensure that confidential information is not disclosed in error or the wrong people have privileged access to your information. This is especially important in due diligence processes, when potential investors or buyers will require access to your company’s data in the M&A process. This is why it is vital that your VDR provider can provide this functionality. It is essential that your VDR is able support the needs of your industry and/or region. DFIN’s Venue offers a variety of AI features that can increase efficiency and accuracy during contract review.

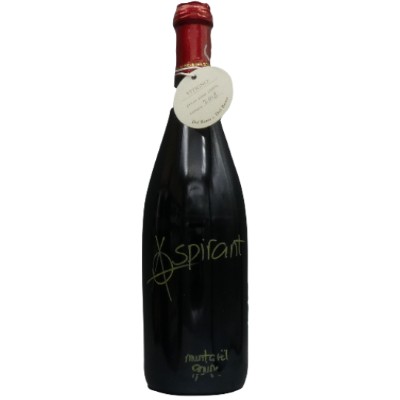

Vini Rossi

Vini Rossi

Vini Bianchi

Vini Bianchi

Spumanti

Spumanti

Champagne

Champagne

Vini Dolci

Vini Dolci

Vini Rosati

Vini Rosati

Vini Liquorosi

Vini Liquorosi Vini Aromatizzati

Vini Aromatizzati