A virtual transaction room (VTR) is an online, secure hub that allows users to collaborate on sensitive documents during high-risk transactions. It is commonly utilized in M&A processes, but it can also facilitate document management and collection capital infusion, as well as other difficult decision-making tasks. VDRs automate a variety of manual processes such as indexing documents, setting permissions and document version control. This results in higher effectiveness, less chance of human error, and a smoother project flow.

Real property transactions require a wide range of documents, such as construction plans, inspections reports financial records, as well as title deeds. VDRs enable real estate professionals to keep an inventory of documents in a single, central location that is available at any time. This allows them http://myvdrnet.org/vdr-basic-software-solutions-list/ to complete their due diligence faster and minimizes the possibility of errors or mistakes when dealing with complicated documentation.

Venture capital and private equity companies deal with complex financial transactions that require document sharing. VDRs enable them to work safely and efficiently with investors, partners, and advisors using a single platform. They can also utilize features like Q&A sections as well as audit trails to monitor activity during projects.

Life science companies are often working with a significant amount of intellectual property that has to be properly managed and stored. VDRs make it easy to categorize and automatically index data items for quick and easy access and optical character recognition tools can search for text within PDFs, images and spreadsheets. VDRs also facilitate collaboration by providing features like previews of files or discussions.

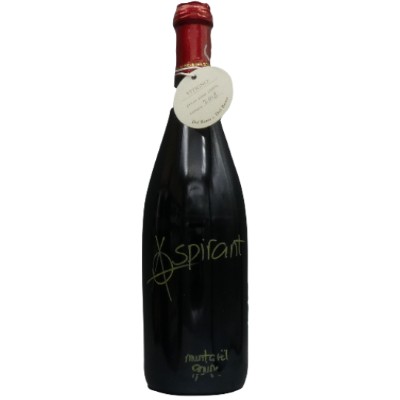

Vini Rossi

Vini Rossi

Vini Bianchi

Vini Bianchi

Spumanti

Spumanti

Champagne

Champagne

Vini Dolci

Vini Dolci

Vini Rosati

Vini Rosati

Vini Liquorosi

Vini Liquorosi Vini Aromatizzati

Vini Aromatizzati