M&A transactions can be a potent tool to help boost your business’s growth. They can increase the variety of products and services you offer as well as allow you to access new markets, and generate new revenue streams that might not have existed prior to. However these benefits may not always show up however, and there are numerous risks to be aware of when looking into M&A opportunities.

A major aspect of M&A is how to structure the transaction. You can make use of the Transaction Assumptions Tab in your model to determine a range of Purchase Prices or a specific Purchase Price. With this information, you can determine the amount of cash that will be required to finance the deal and determine the appropriate fees for financing the transaction.

Once you’ve established the Purchase Price range or an exact Purchase Price It’s now time to calculate the value of the transaction. This involves analyzing the expected returns of non-cash components like equity and cash as well as debt and tangible and intangible assets. It is possible to estimate these figures using your financial models, or by using back-of the nap valuations, like multiples of industry.

You should maximize the value of these non-cash assets because it is the only way to reap profits from your M&A investments. It was previously referred to by the term “economies-of scale” but it can also refer to cost synergies resulting from increased operating size, increased distribution capacity, access to a new markets and risk diversification.

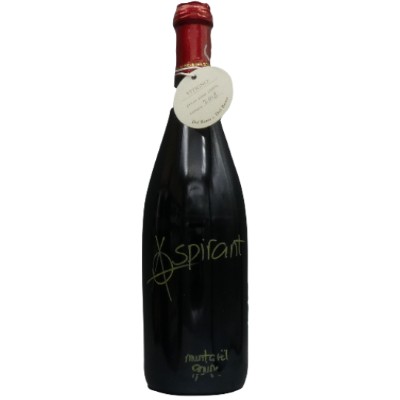

Vini Rossi

Vini Rossi

Vini Bianchi

Vini Bianchi

Spumanti

Spumanti

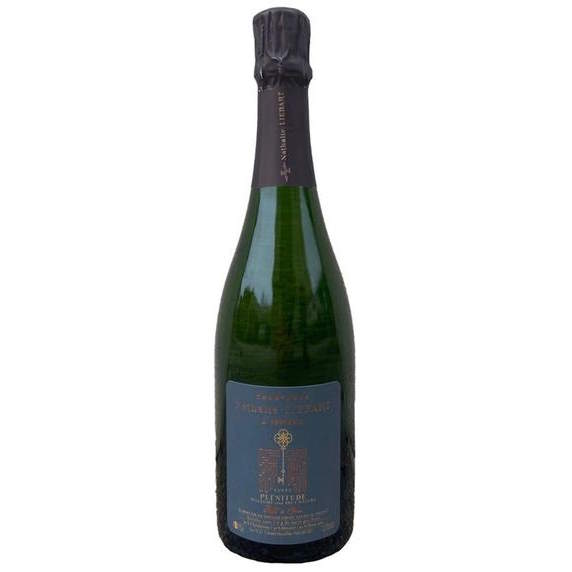

Champagne

Champagne

Vini Dolci

Vini Dolci

Vini Rosati

Vini Rosati

Vini Liquorosi

Vini Liquorosi Vini Aromatizzati

Vini Aromatizzati