Data rooms are a standard part of the due diligence process during mergers and acquisitions. They are also utilized in other types of transactions such as fundraising, IPOs and legal proceedings. They’re a secure method to share data securely with a limited number people who have permissions.

The goal of a virtual data room is to streamline due diligence by allowing more information to be shared, and reduce the chance of miscommunication. The best VDRs include a powerful full-text search feature, a user-friendly indexing tool and folder system to assist users in navigating the data. They also provide dynamic watermarking to stop unintentional duplication and sharing, and permit users to assign permissions to individual files as well as segments of the entire VDR.

The ability to organize and present your data effectively is essential to ensure the experience of investors with your business. Ensure that you have a clear and organized folder structure and clearly label the documents you put in each section. This will save them time and keep them interested in your pitch. Avoid sharing a fragmented and unorthodox analyses. (For example, presenting only a small portion of the Profit & loss statement instead of the full view) This will confuse investors and hamper their ability to http://www.datasroom.net/wix-vs-godaddy-big-comparison-review reach a decision.

Most successful financing processes rely on momentum. You’ll be able to move much faster if your company has the required materials needed by investors prior to their first meeting. A good way to build this momentum is to build your data room according to the above-mentioned framework to ensure that you are able to answer 90 percent of their questions right away.

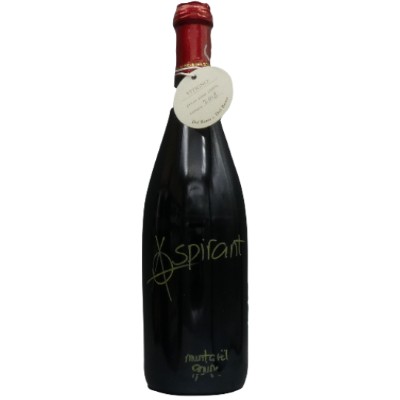

Vini Rossi

Vini Rossi

Vini Bianchi

Vini Bianchi

Spumanti

Spumanti

Champagne

Champagne

Vini Dolci

Vini Dolci

Vini Rosati

Vini Rosati

Vini Liquorosi

Vini Liquorosi Vini Aromatizzati

Vini Aromatizzati