The best virtual data rooms are secure and safe to share confidential information and collaborating. It streamlines corporate governance and allows for efficient project management and knowledge transfer. This helps companies improve their efficiency, and also provide value to clients.

When choosing a VDR to choose from, you should have a peek at this website be aware of the security features and conformance level with industry standards. Select a VDR provider who is well-known in the field and provides user-friendly interfaces with robust support. You should also select a VDR that allows for customization to fit with your brand identity and ensures that your documents are visible.

Accounting involves the exchange of large amounts of sensitive documents and a data space is an excellent tool to share these files with potential buyers. It can be used for due diligence during mergers and acquisitions, fundraising, or board communication. A good VDR will let you upload large files, and offer in-platform viewing. This will accelerate the process. It should also have advanced features for scanning files, such as optical character recognition.

Private equity and high-profile funds companies handle a large amount of confidential information, which calls for enhanced security measures. A virtual data room can help them improve the communication between investors and collaborate using granular security tools, such as privacy folders, remote access control, and watermarking. It can also streamline due diligence and M&A with streamlined workflows for Q&A, eSignature, and Activity Analytics. This can result in faster deals and higher deal value.

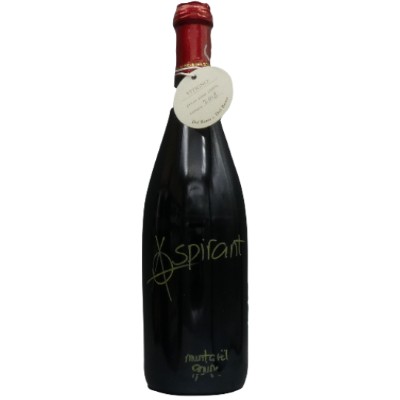

Vini Rossi

Vini Rossi

Vini Bianchi

Vini Bianchi

Spumanti

Spumanti

Champagne

Champagne

Vini Dolci

Vini Dolci

Vini Rosati

Vini Rosati

Vini Liquorosi

Vini Liquorosi Vini Aromatizzati

Vini Aromatizzati