VDR Industry

Large companies generate huge amounts of data that require secure sharing. They are gradually installing VDRs to manage their exclusive data efficiently. Over the forecast period it is expected that this will drive growth in the large enterprise segment. Another reason for this is the growing demand for VDRs from SMEs, who want to safely and easily transfer sensitive documents. This is due to the increase in merger and acquisitions across Asia Pacific.

Dealmakers have known for a long time that a VDR helps to make the M&A process more efficient and less risky. The centralized location for all documents that are related to the data room for real estate transaction allows everyone to access and edit documents in real time. This is a more efficient and cost-effective way to handle documents rather than dealing with physical documents.

Furthermore, a VDR can provide the ability to track and analyze vital information, making it easier for M&A teams to negotiate. This can help prevent confusion and information overload, which can hinder the negotiation process.

Using VDRs VDR can also cut down on administrative costs. The entire M&A can be completed in a fraction of time when a virtual dealroom is utilized. This will also help limit the amount of disruptions that could happen during a deal.

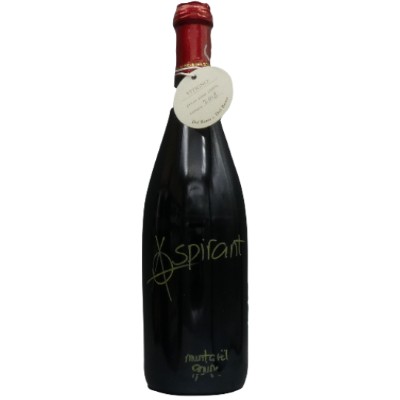

Vini Rossi

Vini Rossi

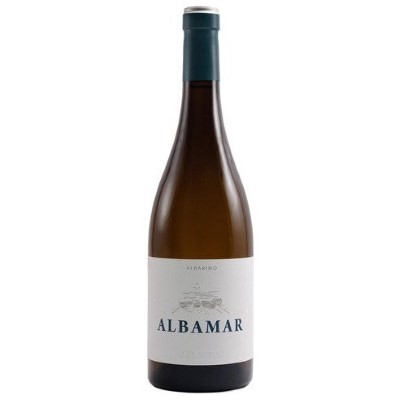

Vini Bianchi

Vini Bianchi

Spumanti

Spumanti

Champagne

Champagne

Vini Dolci

Vini Dolci

Vini Rosati

Vini Rosati

Vini Liquorosi

Vini Liquorosi Vini Aromatizzati

Vini Aromatizzati