A commercial data room (CDR) is a digital repository that holds confidential information securely. It is perfect for M&A or fundraising procedures since it allows users to share documents with other parties without compromising the security standards of your company. Data rooms have a wide range of features that help you ensure the security of sensitive information, including encryption, two-factor authentication and watermarks. They allow collaboration by allowing different stakeholders to work simultaneously on the same project.

The most efficient commercial datarooms have a clear layout of folders and document titles that make it easy for users to find information. The best commercial data rooms also offer comprehensive explanations of the content of each document to ensure that everyone is on the same page. This speeds the process of due diligence by decreasing the number of questions that need to be addressed.

M&A transactions require a large amount of paperwork to be scrutinized. The process of review can take months to complete because it is costly and time-consuming for searchers to go through physical documents. A virtual data room, such as Ansarada Deals helps streamline the due diligence process using AI-powered insights that make it easier and faster for all parties to execute a successful deal.

wificonnectedappliance.com/corporate-data-room-for-effective-interaction

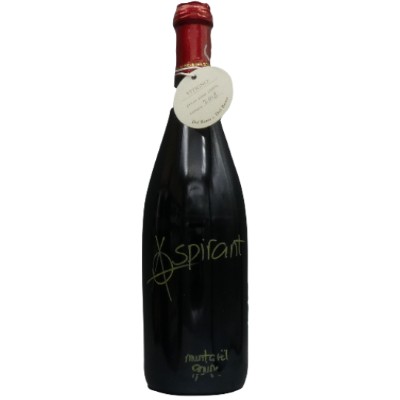

Vini Rossi

Vini Rossi

Vini Bianchi

Vini Bianchi

Spumanti

Spumanti

Champagne

Champagne

Vini Dolci

Vini Dolci

Vini Rosati

Vini Rosati

Vini Liquorosi

Vini Liquorosi Vini Aromatizzati

Vini Aromatizzati