Due diligence in the data room is an essential aspect of any M&A deal. It allows secure online collaboration between many parties, saving time as well as money. It also offers security and transparency in a document management system than traditional file storage methods. The best virtual datarooms include advanced security features, simple-to use software, and custom options that can be adapted to suit any business process.

To create a dataroom to facilitate due diligence it is important to anticipate the documents that will be requested. digitize physical files by scanning and arrange them into folder structures using an easy-to-use indexing. Once the structure of the files has been established, it is important to ensure that permissions are set up properly especially for external users. This includes restricting download, printing and editing rights. Also, you can add custom watermarks for your PDFs and allowing fence views to discourage the unauthorized use of sensitive information.

Choose a provider of a data room that offers advanced security features, a user-friendly interface and drag-and drop uploads. You can also grant permissions for the upload. Make sure to choose 256-bit AES data encryption and robust server backups, two-factor authentication, and other mechanisms to prevent the sharing of unpermitted information.

Try out the trial of the company you’ve selected to see if you like the user interface and how easy it can be to navigate. Compare pricing models and select the one that is right for you. Also ask your provider if they have any additional features to complete your due diligence.

www.boardbook.blog/top-opportunities-with-data-room-due-diligence/

Vini Rossi

Vini Rossi

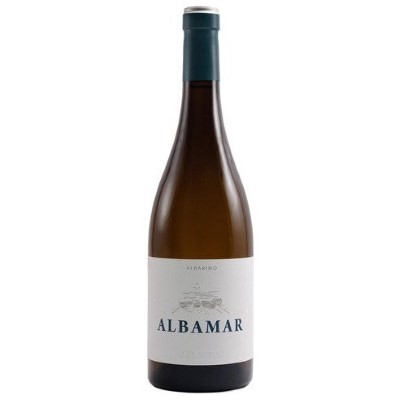

Vini Bianchi

Vini Bianchi

Spumanti

Spumanti

Champagne

Champagne

Vini Dolci

Vini Dolci

Vini Rosati

Vini Rosati

Vini Liquorosi

Vini Liquorosi Vini Aromatizzati

Vini Aromatizzati