Finding the right virtual dataroom (VDR) becomes critical when a business procedure calls for sharing large amounts documents with multiple counterparties. A VDR with clear permissions and specific tracking of activities makes it easy for auditors and reviewers to understand what documents they’re examining. Search and versioning features can reduce the chance of miscommunication or errors that could delay processes. The ability to upload and organize thousands of files at once saves time and money.

During due diligence as well as mergers and contract negotiations, among other business transactions, it is essential that everyone has access to the same documents. Modern VDRs provide customizable access permissions as well as advanced security features that prevent duplicate files, unauthorized accesses and data breaches.

A VDR is an online document management tool that allows secure, efficient and on-demand storing and sharing of documents in the form of folders or individual files. Businesses of all sizes, ranging from small startups to large enterprises, can use it to share confidential documents with partners, clients, or potential investors. VDRs are often utilized in M&A due diligence and asset sales, fundraising and joint ventures, but can also be beneficial for collaboration with customers or external service providers.

VDRs offer a www.openinfo24.com/hdmi-vs-dvi-which-is-better/ seamless and user-friendly experience, whether they’re new or experienced. Templates for folders and due-diligence checklists make it easy to upload and organize large files. Drag-and drop functionality as well as a customizable interface and drag-and-drop functionality enable rapid set-up and familiarization. Enhanced security, sophisticated Q&A capabilities, reports and analytics automate and streamline processes, while the capability to watermark documents helps protect sensitive information and increases compliance.

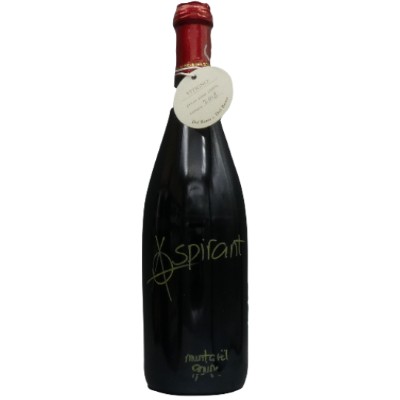

Vini Rossi

Vini Rossi

Vini Bianchi

Vini Bianchi

Spumanti

Spumanti

Champagne

Champagne

Vini Dolci

Vini Dolci

Vini Rosati

Vini Rosati

Vini Liquorosi

Vini Liquorosi Vini Aromatizzati

Vini Aromatizzati