merrillbrinkdeal.com/best-portable-laptop-battery-chargers-and-power-banks-of-2021

A virtual dataroom can streamline M&A due-diligence and other securing document sharing processes by making it easier for bidders to engage, reducing timelines and increasing the chance of success. However, not all VDRs are made equal. Consider the following criteria to help you select the right VDR to meet your requirements:

It is simple to configure and easy to use

A user-friendly and easy interface ensures that users across departments can utilize the platform without having to request training. You should select an organization that provides 24/7 support to ensure that any issues can be resolved quickly. You should be in a position to search your documents, open them using a high-quality viewer, and assign permissions quickly. Avoid vendors who charge astronomical fees per page, or per user.

Advanced security features

The most reliable online data storage facilities offer advanced encryption and security measures to safeguard your data. Look for a provider that has multi-file redaction, AI contract analytics, virus scanning, watermarking and access control based on role. These capabilities allow you to conduct thorough due diligence in a safe manner.

Many vendors also have a full lifecycle management software that allows you to communicate, collaborate and manage projects. This makes them ideal for M&As and other complex deals requiring extensive documentation and collaboration across a variety of teams. Look for a vendor that has a project management software that can be integrated to simplify and manage the entire process. Find a vendor that has an established track record of satisfaction with customers and an extensive client base that includes the top firms.

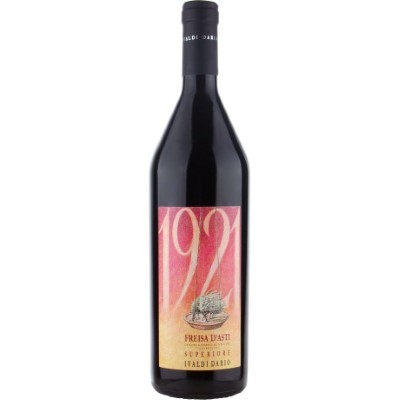

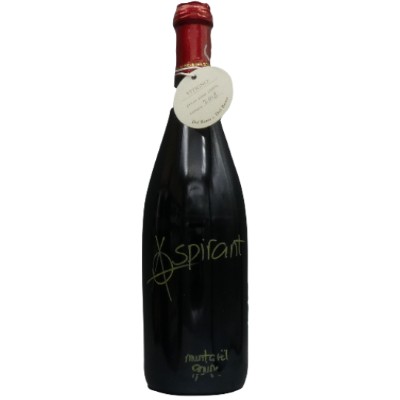

Vini Rossi

Vini Rossi

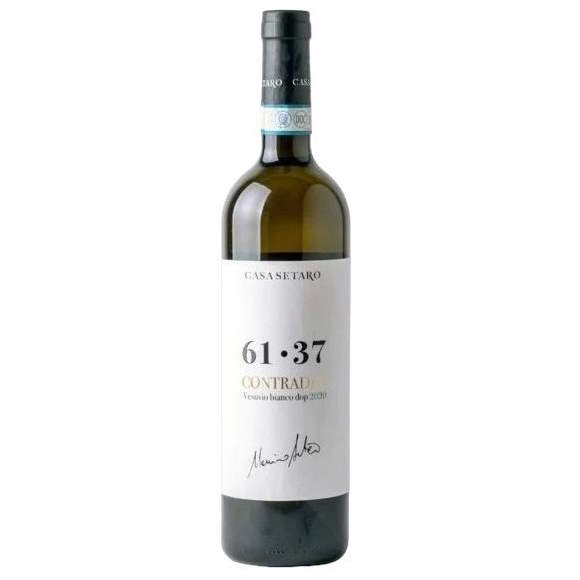

Vini Bianchi

Vini Bianchi

Spumanti

Spumanti

Champagne

Champagne

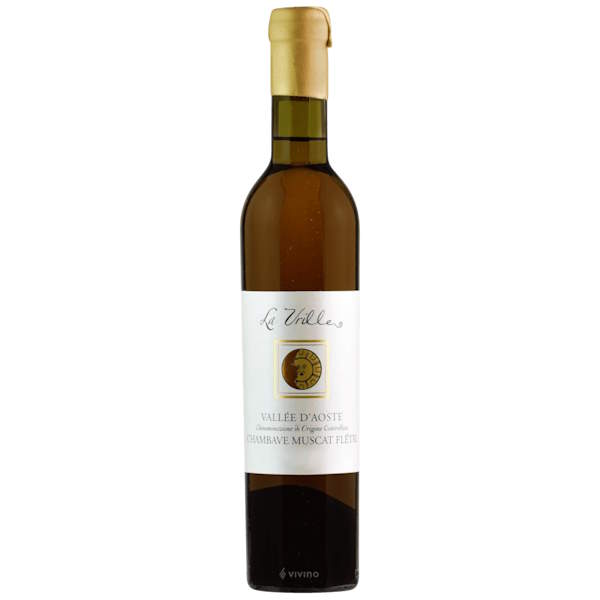

Vini Dolci

Vini Dolci

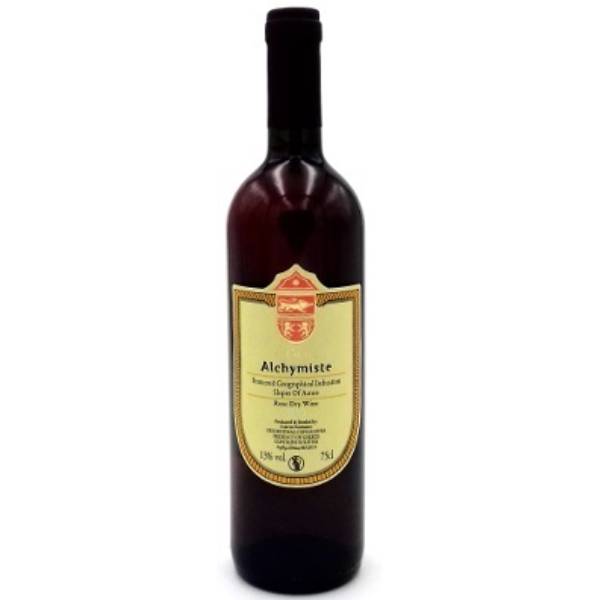

Vini Rosati

Vini Rosati

Vini Liquorosi

Vini Liquorosi Vini Aromatizzati

Vini Aromatizzati