Around $2tn of illicit cash flows per year through the financial system worldwide despite efforts from regulators and financial institutions. One method to combat dirty money is with enhanced due diligence (EDD), a deep know your customer (KYC) process that focuses on transactions that have higher risk of fraud.

EDD is generally considered to be a higher level of security than CDD and can involve more details requests, such as sources of funds and wealth, corporate appointments, and connections with other individuals or companies. It also often involves more extensive background checks, like media searches to discover any reputational or publically available evidence of criminal activity that could be a risk to the bank’s business.

The regulatory bodies have guidelines for when EDD should be activated. This is usually based on the type of customer or transaction and whether the person in question is a politically exposed person (PEP). It is the decision of each FI whether they want to add EDD to CDD.

It is important to have policies that clearly communicate to employees what EDD expects and what it does not. This can help to avoid high-risk situations that can lead to huge fines for fraud. It’s also vital to have an accurate identity verification process that enables you to detect alarms such as hidden IP addresses, spoofing technology, and fictitious identities.

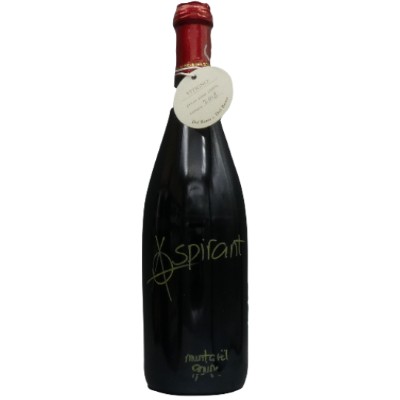

Vini Rossi

Vini Rossi

Vini Bianchi

Vini Bianchi

Spumanti

Spumanti

Champagne

Champagne

Vini Dolci

Vini Dolci

Vini Rosati

Vini Rosati

Vini Liquorosi

Vini Liquorosi Vini Aromatizzati

Vini Aromatizzati