A vdr is essential for any merger or acquisition. The advanced capabilities designed with a professional’s perspective in mind make them indispensable tools for complex business transactions and crucial processes where the safe and secure sharing of files is vital for success.

In contrast to the generic file-sharing platforms such as Dropbox or Google Drive, VDRs provide complete access control and security features that allow you to determine exactly who is permitted to access what documents. You can also determine who has accessed the information, and when it was accessed, giving transparency and accountability, as well as helping you avoid any potential miscommunications that could derail your deal.

VDRs also facilitate real-time collaborative work amongst the different parties involved with M&A transactions, including accountants and legal teams. This lets them work in a single environment, eliminating the necessity for face-toface meetings, and cutting down on delays, costs, and scheduling conflicts.

Most vdrs come with superior indexing and organizing functions, which make it easier to find the information you require. Due diligence is therefore enhanced in speed and efficiency. They also have AI support, allowing them to automatically check the files m&a tools: enhancing deal efficiency and closing transactions faster for sensitive information and suggest redactions. This can reduce the time needed for reviewing and improves the chances of catching errors that could otherwise be missed.

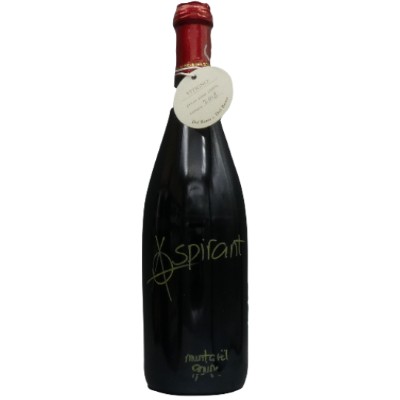

Vini Rossi

Vini Rossi

Vini Bianchi

Vini Bianchi

Spumanti

Spumanti

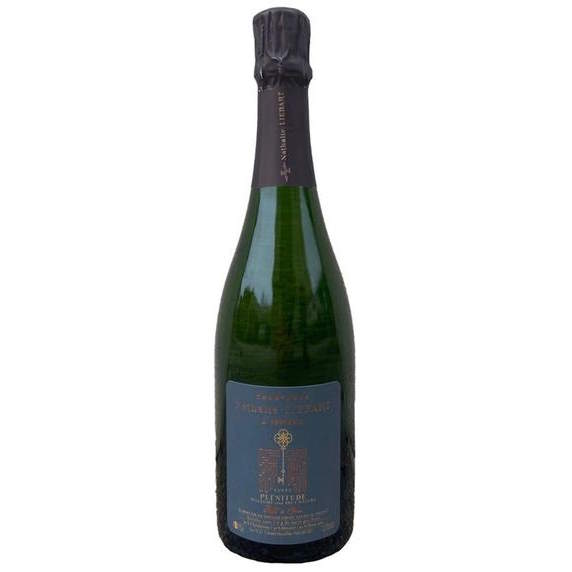

Champagne

Champagne

Vini Dolci

Vini Dolci

Vini Rosati

Vini Rosati

Vini Liquorosi

Vini Liquorosi Vini Aromatizzati

Vini Aromatizzati